The main conclusions of this analysis identifies the key indicators that will influence the real estate market in Spain in the coming months, as well as the main market trends and challenges for 2024.

1.- The evolution of inflation will mark the year 2024, new pressures could limit the growth of the Spanish economy as a whole, among other reasons, as a result of weakened foreign demand, as can be seen in indicators such as the slowdown in exports, especially of goods, or even in foreign home sales, especially in those European countries with the highest inflationary impact.Measures aimed at supporting the increase in energy prices will be phased out, while others aimed at alleviating part of the effects of inflation on Spanish households will be extended.

2.- The labor market closed the 2023 financial year with an upward trend in terms of Social Security enrolment. Specifically, more than 500,000 new affiliates have been registered, almost reaching the figure of 21 million.

However, it is worth studying each statistic in detail and analyzing the quality of the employment generated.

3.- Slight recovery in household purchasing power, as wages and inflation are growing at a similar pace. However, the outlook for 2024 points to subdued consumption, due to the loss of disposable income that has occurred during 2022 and 2023, and the slowdown in the savings rate over the last few quarters.

4.- Confidence continues to fluctuate in all three areas (business, consumer, and real estate), but improving economic expectations, both at the country and household levels, and solid employment figures, anticipate a potential upturn in the indices.

5.- In turn, the evolution of the economy will condition the mortgage market. Among the key factors to bear in mind are:

The evolution of the Euribor, which has already fallen for two consecutive months, as a leading indicator that could point to an easing of the ECB's monetary policy, foreseeably from the second half of 2024.

The expectation of lower interest rates in 2024 may lead to a possible change in the balance of fixed-rate and variable-rate mortgages.

6.- In general terms, the real estate market continues to show great resilience in terms of the level of activity, despite the fact that home sales and purchases have been declining for nine months in a row year-on-year. Used housing continues to be the segment most affected by the rise in the cost of financing, with a 9.9â year-on-year drop in transactions between January and October 2023, sharper than the figure recorded for new housing (-3.6â).

7.- Despite a generalized loss of dynamism in home sales and purchases, it is important to differentiate by market. By autonomous region, the Community of Valencia, the Region of Murcia and the north of Spain, in general, reflect a better performance in the number of transactions than last year; but it is Andalusia, the Community of Madrid and Catalonia that account for one out of every two transactions.

In terms of provincial capitals, Madrid, Barcelona, Alicante, Malaga and Valencia account for 40a of demand, with the capitals of the Levante region, and some in the interior, being the ones that best maintain their pace of sales in annual terms.

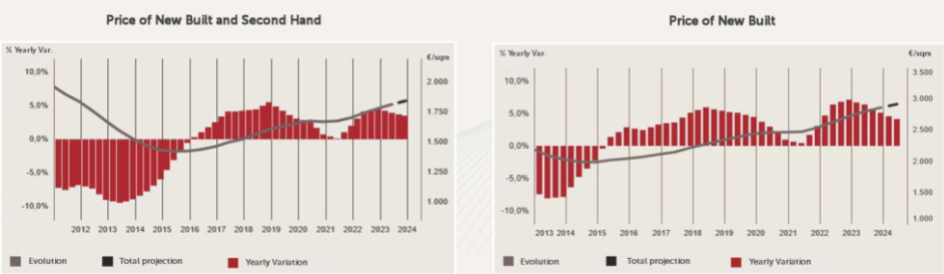

8.-Overall, house prices are approaching a new turning point: the trend for the coming quarters remains upward, but a slowdown in average unit growth is expected to become increasingly evident.

If we talk about new housing, the average price projection for June 2024 is €2,925 per sqm, which would represent a year-on-year increase of 4.1â compared to the 6.4â recorded in June 2023. The selling times extend, and the pace of price increase decelerates.

9.- Different market dynamics are also observed at the level of new housing prices: in all autonomous communities, it grows by more than 2% annually as of December 2023, but it is the Balearic Islands and Madrid that lead the ranking, with a year-on- year rate of over 6â.

In terms of provincial capitals, the highest average price for new-build properties is found in Barcelona (€5,156 per sqm), and the cities of Barcelona, Madrid and San Sebastiàn all exceed the C4,000 per sqm barrier. In turn, Malaga city is positioned, for the third consecutive year, as the Spanish capital where the price of new housing has grown the most over the last year (7.2%).

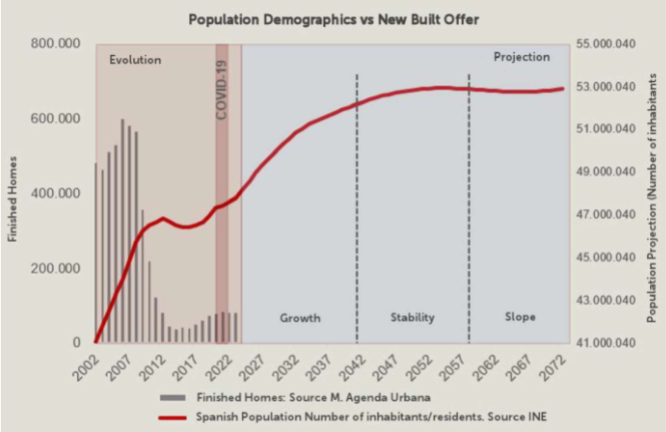

10.- Over the last decade, an imbalance between housing supply and demand has become evident in Spain. This trend could intensify over the next 20 years, if the current levels of new housing construction, which are between 80,000 and 1 00,000 units per year, are maintained, which is insufficient to cover the projected number of new households, which would be around 200,000 families on average each year.

If we consider the population projection for the next 15 years, 50% of the new demand for housing will be concentrated in Catalonia and the Community of Madrid. In these two communities alone, 800,000 new homes would be needed. At the same time, areas such as Castilla y León and Asturias will be conditioned in this respect by the phenomenon of depopulation.

Comparison of housing construction versus population projection in Spain.